Employees in our state and in our nation are protected by wage and hour laws that govern how many hours a person can work per week and the minimum wage at which they must be compensated. If you believe that your rights as an employee have been violated and you have a wage and hour complaint, please reach out to a wage and hour attorney at the law office of McOmber McOmber & Luber, P.C. today. We serve clients throughout the state of New Jersey, Pennsylvania, and New York from our offices in Red Bank, NJ, Marlton, NJ, Newark, NJ, New York, NY, and Philadelphia, PA .

Understanding Wage and Hour Laws in New Jersey

Both the federal government and the state of New Jersey maintain wage and hour laws that apply to employees.

On a federal level, the Fair Labor Standards Act (FLSA) establishes the minimum wage, overtime pay, recordkeeping, and youth employment standards for Federal, State, and local government jobs.

On a state level, the New Jersey State Wage and Hour Law requires that all employers must meet minimum wage requirements and pay the overtime rate for all workers covered under the law–the overtime rate in our state is payment of 1.5 times the normal rate of payment for all hours worked over 40 hours within a seven-day time period.

Other Rights You Have Related to Wages and Hours

In addition to the right to receive the minimum wage and the right to be paid time and a half for any hours worked over 40, as an employee in New Jersey, you may also have the right to:

- Earned sick leave.

- Family and medical leave.

- Leave for certain protected actions, such as voting.

- To be free from the withholding of wages for illegal deductions.

If you are unsure of your rights, please contact an experienced New Jersey wage and hour attorney at our law firm to learn more.

Wage and Hour Class Actions

Employers that do not comply with state and federal laws can be subject to wage and hour class action lawsuits. These lawsuits involve a group of employees (called classes) whose rights have been violated, and team up to pursue a class action claim. Wage and hour class actions have benefits over individual lawsuits. For example, it is more efficient to file one claim instead of hundreds or thousands, and it is a good way to ensure that employers follow the rules regarding wage & hour laws.

If you think you have a potential wage and hour class action case, reach out to a wage and hour attorney at our law firm to request a free consultation. We can provide you with advice and guidance for recovering compensation for any harm and damages you and your potential class have suffered.

NJ Wage and Hour Laws Regarding Tips, Commission, and Overtime

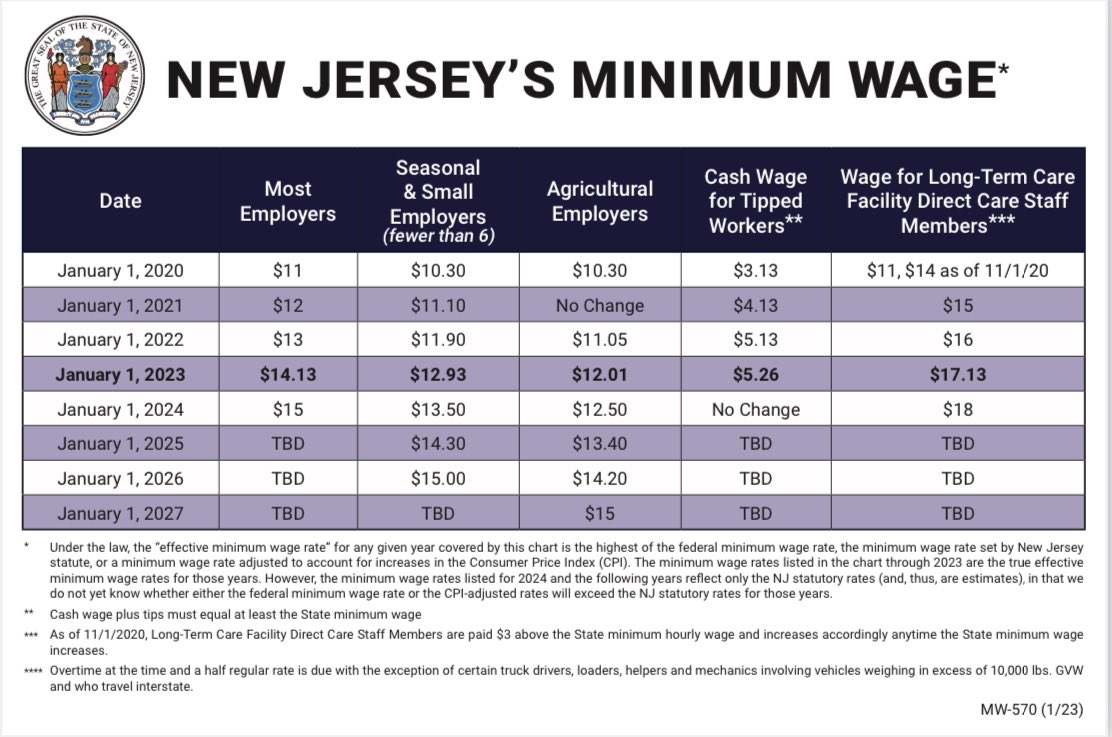

All workers are guaranteed a minimum wage by federal, state, and sometimes local laws, and employers must pay by whichever standard is the most generous to the employee. In New Jersey, the state minimum wage is higher than the federal minimum wage so workers receive the state minimum wage. Hourly workers must be paid the minimum wage for all hours worked, not an average, and not more than minimum wage for some hours and less for the others. There are special rules regarding tips, commission, and overtime as they relate to hourly wage.

Tips

Tips belong to the employee and not the employer. There are two exceptions to this rule. One is the tip credit. In New Jersey, employers may count part, or all of an employee’s tips toward the minimum wage requirement. This means the employer may pay less than the minimum hourly wage if the employee’s tips make up the difference. At the end of the workweek, if the tips are not enough to equal minimum wage for each hour worked, then the employer is responsible for paying the difference.

The other exception is the tip pool. With written notification, employers may require employees who regularly receive tips to contribute a portion of the tips to a pool. The pooled tips are then divided evenly among the group of employees.

Commissions

For employees working on a commission system, the minimum wage requirement must still be met. In other words, total pay divided by the number of hours worked must average out to minimum wage. Commissions are considered wages and not supplementary incentives or discretionary bonuses. The commission structure may not be changed without prior written notice to the employee.

Overtime

Overtime for all hourly workers is one and a half times their hourly wage, regardless of tips. Any hours worked over the standard 40-hour work week should be paid at the overtime scale. Some employers may try to avoid their overtime obligations by handing out “bonuses.” It sounds great, but the legal definition of a bonus is compensation paid out above wages owed, in return for loyal service or extra effort shown, or as a gift. Always carefully calculate whether your wages have been correctly paid.

New Jersey Earned Sick Leave

Under the New Jersey Earned Sick Leave Law that took effect October 2018, nearly all employees working in the state are entitled to paid sick leave through their employers. This law applies to both full-time and part-time workers, regardless of whether they are paid hourly wages, salary, or via tips or commissions.

Employees accrue one hour of sick leave for every 30 hours of work. They may accrue up to 40 hours of sick time within the benefit year, which is 12 consecutive months of work as designated by their employer. If the worker has not used the sick leave time accrued by the end of the benefit year, the employee may carry over up to 40 hours to the next 12-month period or calendar year or receive a payout for the unused time at the discretion of the employer.

Employers cannot refuse to offer paid sick leave to eligible employees. They are further prohibited from disciplining workers for asking about or using their earned sick leave. Those who believe their employers are in violation of the law, or those who have suffered harm for exercising their rights should contact a skilled New Jersey wage and hour lawyer to discuss their legal options.

What Are The Most Common Wage and Hour Law Violations?

Some of the most common wage and hour law violations taken by employers include, but are not limited to:

- Tip Skimming – Tip skimming refers to the unlawful practice of restaurant owners or managers taking a portion of tips that belong to the restaurant’s employees.

- Withheld Wages or Failure to Pay Minimum Wage – Employers will sometimes find ways to withhold wages that you have rightfully earned, or find ways to pay you less than minimum wage, both of which are against the law.

- Illegal Deductions – charges for uniforms, portraits, and business expenses, among others, are all examples of illegal deductions on an employee’s paycheck.

- Misclassified Employees – Some employers will intentionally misclassify an employee as an independent contractor as a means to deprive them of the benefits associated with proper employment (such as being misclassified as “exempt” from earning overtime.)

The above are just a handful of some of the most common forms of wage and hour law violations taken by employers, and not a comprehensive list. If you believe you have been subjected to one of the violations listed above, or one that isn’t, discuss your situation with an experienced wage and hour attorney.

What to Do if You Have a Wage and Hour Claim in NJ

If you are thinking about bringing forth a wage and hour claim, or joining a wage and hour class action lawsuit, we strongly recommend consulting with a skilled attorney who has experience representing employees like you in wage and hour disputes. We can help you to gather evidence to support your claim, and pursue a wage collection proceeding, if necessary.

Whistleblower Protection for Wage and Hour Issues Under CEPA

Any New Jersey employee who feels his/her paycheck does not accurately reflect the work they are doing has the right to question their employer’s practices without fear of retaliation. The Conscientious Employee Protection Act (CEPA) provides general whistleblower protection to the employee who brings to light illegal, fraudulent, or criminal behavior of his/her employer.

Under this law, the employer may not retaliate against an employee for threatening to disclose or complain to a public body that they are owed unpaid wages or commissions. If there is any adverse employment action against that employee, the employer may be liable for any damages and legal fees incurred by the employee. The employee has the responsibility to first inform the employer in writing of the disclosure/complaint and give them time to correct it.

CEPA provides protection to those who have a reasonable belief or suspicion their employer is violating the law by withholding wages or commissions. Even if it cannot be proven or turns out not to be true, an employer may not engage in retaliatory actions against the employee.

Schedule a Consultation With Our Wage and Hour Attorneys Now

Being denied the wages that you are owed, being asked to work overtime without compensation, or being denied time off that you are legally entitled to is more than frustrating — it is illegal. If you believe that your employer has violated your rights under state or federal wage and hour laws, we urge you to reach out to us. We have years of experience representing employees and will fight for your wages. Reach us today by phone or online for a free consultation.