Some employees earn tips or gratuities in addition to receiving an hourly wage from their employers. In NJ, these employees are subject to New Jersey Wage and Hour Law and the New Jersey Payment Law, which differs from federal law in several respects.

Under NJ law, tipped employees have the same rights as hourly employees and salaried employees regarding fair pay, benefits, protection from discrimination, and the right to engage in protected activities without fear of employer retaliation.

In cases of wage & hour violations, the employment lawyers at McOmber McOmber & Luber are here to help make sure that tipped employees are paid what they are entitled to under the law.

Do New Jersey Tipped Employee Laws Apply to Your Job?

The legal definition of a tipped employee is one who usually receives at least $30 in tips per month. An employee who customarily and regularly receives more than $30 in tips over a one-month period, but occasionally does not, is also considered a tipped employee.

What is the Minimum Wage for Tipped Employees?

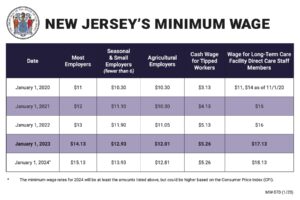

Under New Jersey Wage and Hour Law, an employer is permitted, but not required, to apply up to a set maximum amount of an employee’s tips toward the employer’s obligation to pay the full state minimum hourly wage. This is called taking a tip credit. The maximum tip credit allowed under the NJ Wage and Hour Law is scheduled to increase annually through 2024.

Tip skimming refers to the unlawful practice of restaurant owners or managers taking a portion of tips that belong to the restaurant’s employees. Tip skimming normally coincides with tip-pooling, the practice of sharing tips between the staff, including servers, waiters, bartenders, chefs, and dishwashers. When tip-pooling is utilized, owners and managers can easily skim tips from the pool without employees’ knowledge. Some owners and managers also attempt to conceal their tip skimming in pay-stub deductions labeled “meal credits” or “admin fees”.

Ways to Detect Unlawful Pay & Tip Skimming

Detecting tip skimming can be difficult unless you know what to look for. Some of the more common warning signs of tip skimming include:

- An hourly wage below $5.26

- Earning below minimum wage ($15.13 per hour in New Jersey)

- Significant and unclear payroll deductions

- Unclear, confusing, or “fly-by-night” tipping procedure

- Tipping procedure that changes frequently

- Meal deductions that are greater than the cost of the food

Additionally, by keeping detailed records of your hours and tips, and discussing any discrepancies with your coworkers, you will not only be able to detect tip skimming or other unlawful behavior, but also have evidence of how often this has occurred, and how much you (or your coworkers) are owed.

Legal Remedies to Recover

If you are a tipped employee and believe your restaurant illegally tip-skimmed or withheld your earned wages, McOmber McOmber & Luber, P.C. can help you recover the earnings you deserve. Generally, you can sue your employer for unfair business practices, fraud, and misrepresentation. Furthermore, certain wage and tip violations can warrant criminal prosecution by the State of New Jersey.

After complaining or reporting tip-skimming or unlawful wages, any retaliation or adverse employment actions – which can include termination, reduced hours, demotion and more – is unlawful. Employers who retaliate against tipped employees who complain or report unlawful wages, may face a whistleblower or retaliation lawsuit.

Retaliation against an employee who reports labor law violations is illegal, and there are penalties for employers who engage in this unlawful practice, including requiring them to provide you with the pay that you were wrongfully denied.

Seeking Legal Counsel and Representation

If you believe that you are a victim of tip skimming or other wage and hour violations, it is imperative to consult with an experienced and reputable employment litigation lawyer. With offices in Red Bank, NJ, Marlton, NJ, Newark, NJ, New York, NY, and Philadelphia, PA , the wage and hour lawyers at McOmber McOmber & Luber, P.C. represent clients across the state. Contact us today for a free consultation.