Unpaid Overtime and Wage and Hour Claims

The relationship between an employee and employer is built upon trust. Employers must trust that their workforce is performing job duties to the best of their abilities, while employees must trust that they will be compensated in accordance with the Fair Labor Standards Act (FLSA).

Occasionally that trust is broken, but violations of the statute are enforceable in court.

What are New Jersey’s Wage and Hour Laws?

Both the federal government and state of New Jersey maintain wage and hour laws that apply to employees.

On a federal level, the Fair Labor Standards Act (FLSA) establishes the minimum wage, overtime pay, record keeping and youth employment standards for Federal, State and local government jobs.

On a state level, the New Jersey State Wage and Hour Law requires that all employers must meet minimum wage requirements and pay the overtime rate for all workers covered under the law.

What is New Jersey’s Minimum Wage?

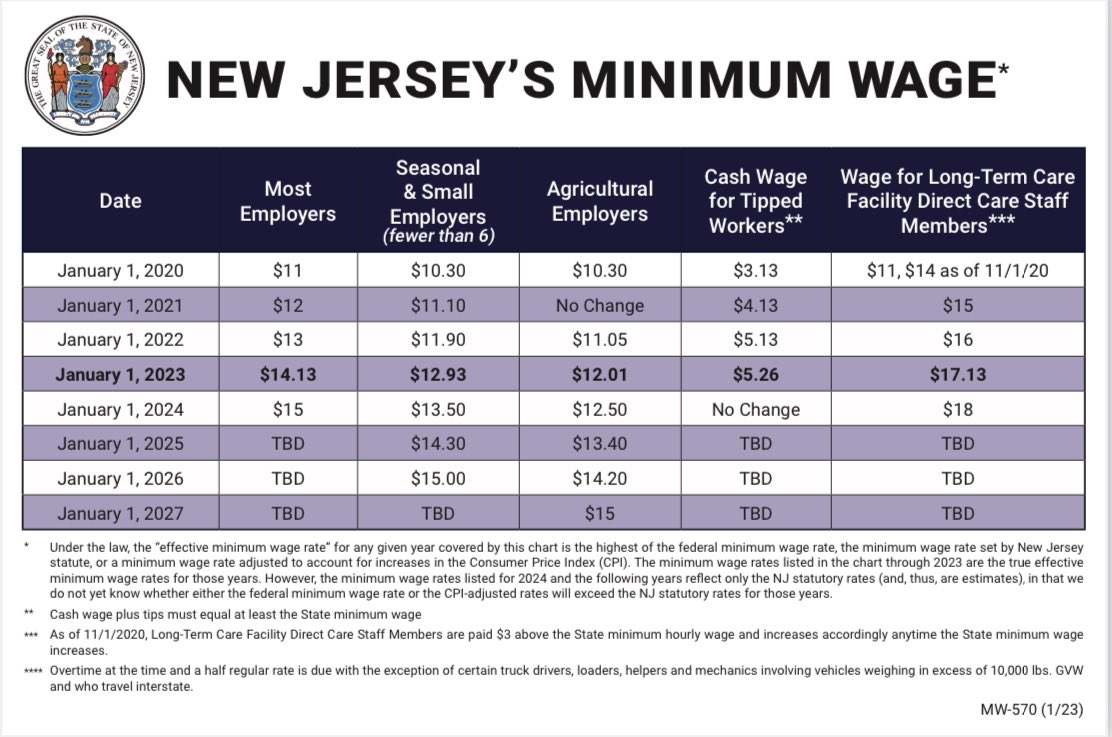

The minimum wage guaranteed by the FLSA is currently $7.25 an hour, but New Jersey residents enjoy a state-mandated minimum wage of $15.13 per hour, as of 2024.

Although some positions – such as a hairdresser or waiter – pay a significantly lower hourly rate than what the state guarantees, their income is expected to reach the state’s minimum wage threshold via tips.

When tips fail to bring an employee to the state-mandated minimum wage, however, an employer must bridge the gap.

An employer’s failure to bring an employee’s hourly salary up to the New Jersey minimum wage may trigger legal action, as can the common practice of forcing tipped employees to clock out when business is slow.

Tip skimming is another common but illegal practice in the restaurant industry. Tip skimming occurs when restaurant owners or managers unlawfully take a portion of employees’ earned tips. Because many employers try to conceal their unlawful actions under the guise of “tip pooling” or charging for “meal credits”, workers may not be aware they are being cheated out of money they have rightfully earned.

What is New Jersey’s Overtime Rate?

Typically, the overtime rate for all hourly workers is one and a half times their hourly wage for any hours worked over the standard 40-hour work week.

Some employers may try to avoid their overtime obligations by handing out “bonuses.” It sounds great, but the legal definition of a bonus is compensation paid out above wages owed, in return for loyal service or extra effort shown, or as a gift. Always carefully calculate whether your wages have been correctly paid.

Overtime Violations Occur Frequently but Must be Reported

Employees also frequently invoke the FLSA when they have worked an excess of 40 hours per week but were either unpaid for their overtime or paid less than the time-and-a-half they are guaranteed under the statute. Employers have proven adept at developing strategies for evading their overtime pay requirements; however, the law is firmly on the side of employees.

To that end, pre-shift and post-shift work must be counted towards a worker’s weekly hours. Such work can include a roll call or time spent preparing a work environment prior to the official start of the work day.

Additionally, some jobs require special gear or a uniform that can only be donned or doffed on-site. Employees are able to count this time towards their weekly number of total hours worked. Employers are also barred under the FLSA from automatically deducting a lunch break from an employee’s schedule when the employee did not take one, and docking a worker for short breaks of less than 20 minutes.

Overtime Requirements Differ Amongst Positions and Industries

Exemptions to the FLSA’s overtime requirements do exist, however.

Certain classes of workers – including those who work on commission, domestic workers who reside with their employer, and farmworkers – may not be entitled to time-and-a-half for working in excess of 40 hours per week. Furthermore, those who work in a hospital or residential care facility often have separate overtime requirements. Typically, such workers must be paid overtime premium pay for all hours worked in excess of eight each day, or when working more than 80 hours in any 14-day period.

Some employees are improperly classified as executives or managers – another worker class exempt from overtime pay under the FLSA. In order to qualify as an executive or manager an employee must have at least two full-time direct reports, as well as the ability to hire and fire. Without such authority, an employee in all likelihood is non-exempt and entitled to overtime pay.

Can my Employer Force Me to Work Overtime?

Yes, your employer can force you to work overtime. The NJSWHL states that employers may force employees to work overtime as a condition of their employment. This works in concert with the federal FLSA, which allows employers to fire employees who refuse to work overtime.

Schedule a Consultation With Experienced Overtime Attorneys Today

Being denied the wages that you are owed, being asked to work overtime without compensation, or being denied time off that you are legally entitled to is more than frustrating — it is illegal.

If you believe that your employer has violated your rights under state or federal wage and hour laws, we urge you to reach out to us. We have years of experience representing employees and will fight for your wages. With offices in Red Bank, NJ, Marlton, NJ, Newark, NJ, New York, NY, and Philadelphia, PA we serve clients throughout those states. Contact us for a free consultation today!